Calculate the Cost of Goods Manufactured Using the Following Information

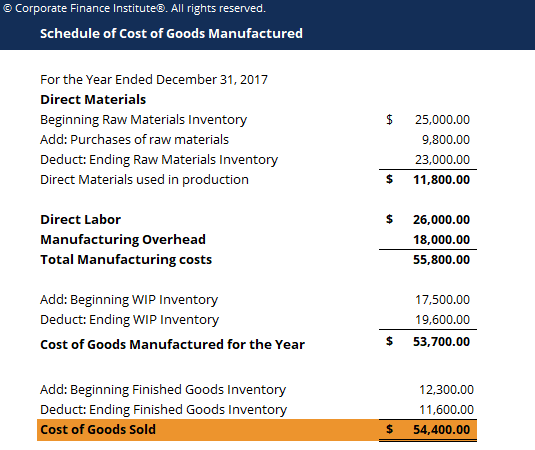

The cost of goods manufactured COGM is a calculation that is used to gain a general understanding of whether production costs are too high or low when compared to revenue. Explanation Cost of Goods Sold Beginning Finished Goods Inventory Cost of Goods Manufactured - Ending Finished Goods Inventory Cost of Goods Sold 233900 Direct Materials Direct Labor Factory OverheadCosts Beginning Work in Process Inventory - Ending Work in Process Inventory - 240500 Cost of Goods Sold 233900 300300.

Cost Of Goods Manufactured Cogm How To Calculate Cogm

Calculate the cost of goods sold by the following information.

. Cost of goods manuf cogsEnding Finished Goods Inventory-Beginning Finished Goods Inventory 540k67k-80k 527k Using the information below calculate gross profit for the period. Costs 555 Finished goods stock 1 January 2018 405 Plant utilities 255. Direct materials used 299100 Direct labor used 132600 Factory overhead costs 264600 General and administrative expenses 86100 Selling expenses 49400 Work in Process inventory January 1 119100 Work in Process inventory December 31 126500 Finished goods inventory January 1.

Calculate the cost of goods manufactured using the following information. Calculate the cost of goods manufactured using the following information. With this template your COGS is 100000 400000 50000 450000.

Using the following information calculate the cost of goods manufactured. The equation calculates the manufacturing costs incurred with the. Completed products ready for sale are referred to as.

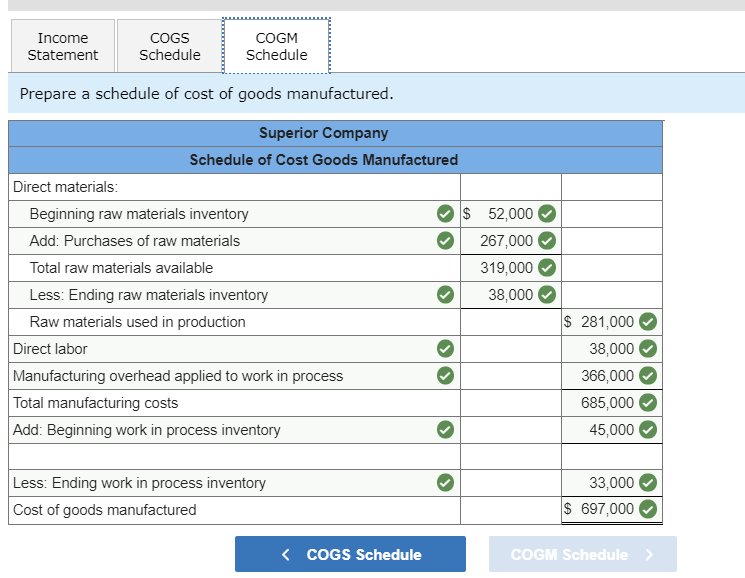

Total Manufacturing Cost 100000 500000 60000 660000. Calculate the cost of goods manufactured for the year. First we need to reach the direct labor cost by multiplying what is given.

Direct materials used 298700 Direct labor used 132200 Factory overhead costs 264200 General and administrative expenses 85700 Selling expenses 49000 Work in Process inventory January 1 118700 Work in Process inventory December 31 126100 Finished goods inventory January 1. Cost of goods manufactured formula. Beginning work in progress 1119300.

Sales 46500000 Raw materials inventory beginning Raw materials inventory ending 3500000 2000000 Purchases of raw materials 9500000 Direct labor. Cost of Goods Sold Opening Stock Purchase Direct Expenses Closing Stock. Cost of Goods Manufactured 450 million 480 million 400 million.

Goods Cost of Goods Sold 80000 Cost of Goods Manufactured - 67000 540000 Cost of Goods Manufactured 13000 540000. Cost of Goods Manufactured 530 million. The following is the formula used to calculate the cost of goods manufactured along with a breakdown of what each piece of the formula means.

Direct Labor Cost 10 100 500 500000. Cost of Goods Manufactured is calculated using the formula given below. 298500 132000 264000 118500 - 125900 687100 687100 232100 - 238700 680500 AACSB.

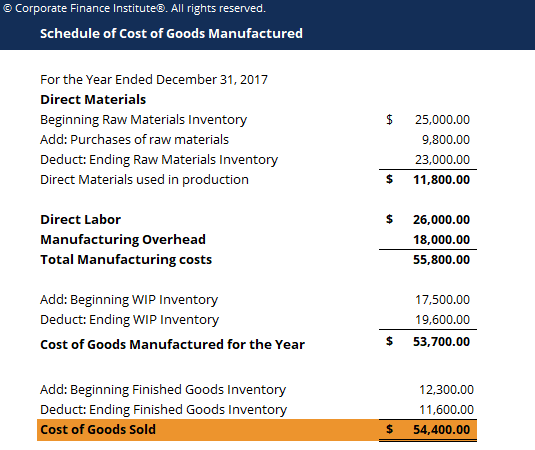

Direct materials 299300 direct labor 132800 factory overhead costs 264800 general and administrative expenses 86300 selling expenses 49600 work in process inventory january 1 119300 work in process inventory december 31 126700 finished goods inventory january 1. Cost of goods sold initial cost net purchase direct expenses final cost. 囲click the icon to view the information i Data Table Finished Goods Inventory.

To calculate the cost of manufactured goods we need to use the following formula. The following data have been taken from the accounting records of ABD Corporation for the just completed year. 687100 Cost of goods manufactured Raw Materials Used Direct Labor Factory Overhead Beginning Work in Process - Ending Work in Process Cost of Goods Manufactured 298500132000264000118500-125900 687100.

The Silk ends the year with 30000 ending work-in-process inventory. Cost of good manufactured Beginning work in progress direct materials of the period direct labor manufactured overhead - ending work in progress. An alternative way to calculate the cost of goods sold is to use the periodic inventory system which uses the following formula.

Up to 256 cash back Calculate the cost of goods manufactured using the following informationDirect materials 298900Direct labor 132400Factory overhead costs 26400General and administrative expenses 85900Selling expenses 49200Work in Process inventory January 1 118900Work in Process inventory December 31 126300Finished. Calculate the cost of goods sold using the following information. Calculate cost of goods manufactured and cost of goods sold from the following account balances relating to 2018 in millions Image transcription text.

Cost of Goods Manufactured Beginning Work in Process Inventory Total Manufacturing Cost Ending Work in Process Inventory. Calculate the cost of goods. Chapter 18 - Managerial Accounting Concepts and Principles 135.

Calculate the cost of goods manufactured using the following information. Carriage And Freight 7000. COGM Beginning work in process WIP inventory Total manufacturing cost - Ending WIP inventory.

Direct materials beginning inventory purchase - ending inventory. Property tax on plant building 045 Marketing distribution and customer-service. Beginning work in process inventory 44000 Ending work in process inventory 41000 Raw materials used 74000 Direct labor incurred 56000 Manufacturing overhead applied 83000 Cost of goods manufactured.

Calculate the cost of goods manufactured using the following information. Calculate the cost of goods manufactured.

Cost Of Goods Manufactured Cogm How To Calculate Cogm

Solved Prepare Schedules Of Cost Of Goods Manufactured And Chegg Com

Cost Of Goods Manufactured Formula Examples With Excel Template

Comments

Post a Comment